Following a year of growth, kitchen cabinet demand in the United States is projected to increase 5.9% per year to $17.1 billion in 2021, according to the recent Cabinets Market in the U.S. study by The Freedonia Group. Tall kitchen cabinets are projected to reach a value of $3.2 billion in 2021 on annual advances of 7.7%, with base cabinets projected at 5.2% annual growth.

Meanwhile, U.S. demand for countertops is forecast to rise just over 2% annually through 2022 to 803 million square feet, according to Freedonia’s study, Countertops in the U.S. Gains will be seen in residential remodeling activity as homeowners continue to opt for larger kitchens and multiple bathrooms, while construction activity in the countertop-intensive office, retail, lodging, and institutional markets will also drive growth.

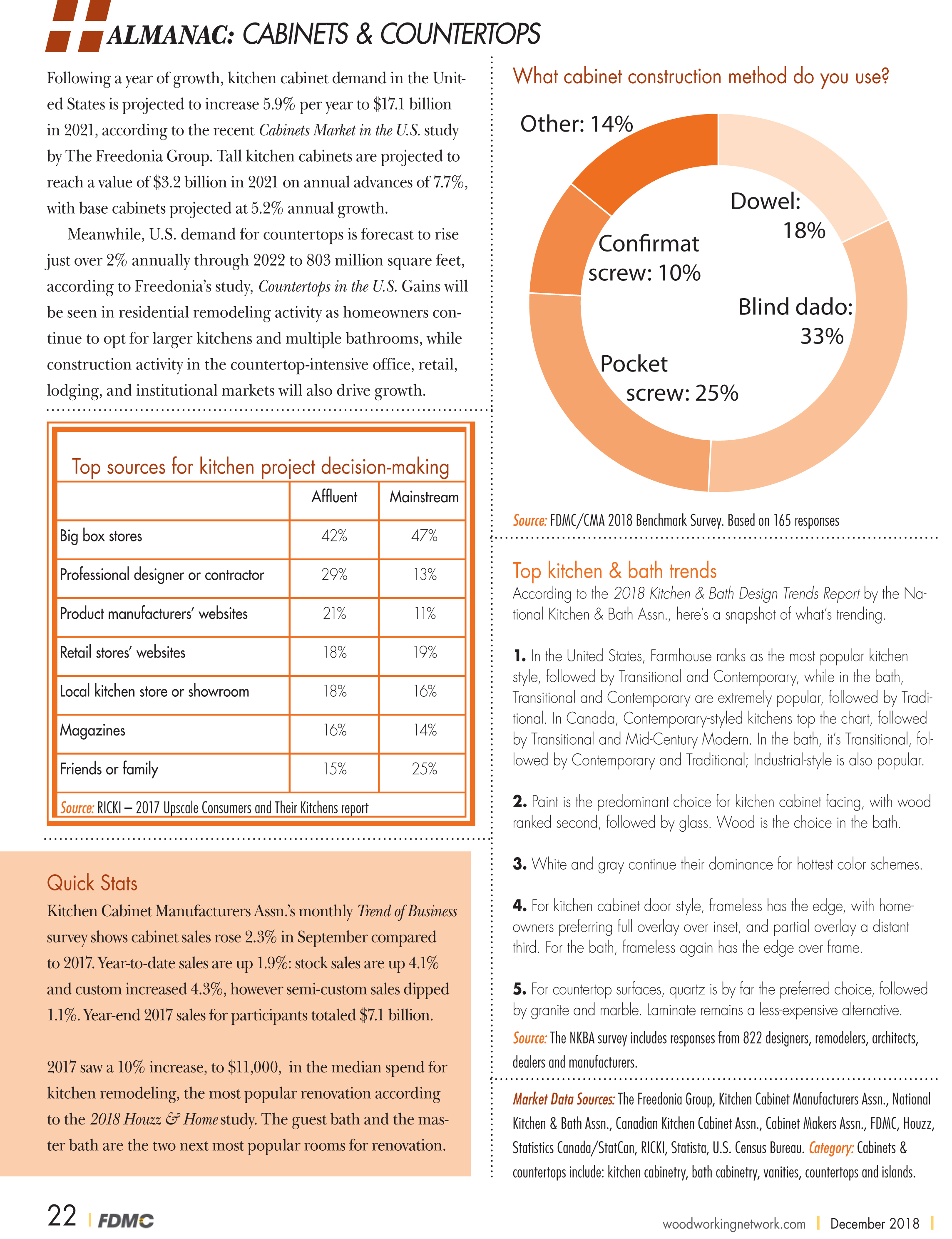

Click to enlarge/download the infographic, plus find more market data in the December 2018 FDMC Wood Industry Almanac.

Top kitchen & bath trends

According to the 2018 Kitchen & Bath Design Trends Report by the National Kitchen & Bath Assn., here’s a snapshot of what’s trending.

1. In the United States, Farmhouse ranks as the most popular kitchen style, followed by Transitional and Contemporary, while in the bath, Transitional and Contemporary are extremely popular, followed by Traditional. In Canada, Contemporary-styled kitchens top the chart, followed by Transitional and Mid-Century Modern. In the bath, it’s Transitional, followed by Contemporary and Traditional; Industrial-style is also popular.

2. Paint is the predominant choice for kitchen cabinet facing, with wood ranked second, followed by glass. Wood is the choice in the bath.

3. White and gray continue their dominance for hottest color schemes.

4. For kitchen cabinet door style, frameless has the edge, with homeowners preferring full overlay over inset, and partial overlay a distant third. For the bath, frameless again has the edge over frame.

5. For countertop surfaces, quartz is by far the preferred choice, followed by granite and marble. Laminate remains a less-expensive alternative.

The NKBA survey includes responses from 822 designers, remodelers, architects, dealers and manufacturers.

Quick Stats

Kitchen Cabinet Manufacturers Assn.’s monthly Trend of Business survey shows cabinet sales rose 2.3% in September compared to 2017. Year-to-date sales are up 1.9%: stock sales are up 4.1% and custom increased 4.3%, however semi-custom sales dipped 1.1%. Year-end 2017 sales for participants totaled $7.1 billion.

2017 saw a 10% increase, to $11,000, in the median spend for kitchen remodeling, the most popular renovation according to the 2018 Houzz & Home study. The guest bath and the master bath are the two next most popular rooms for renovation.

A survey of 1,000 U.S. homeowners found half who used a kitchen designer for a recent project worked with one at a home improvement store, such as Lowe’s or Home Depot. RICKI’s survey, How Homeowners Shop for Kitchen Products, noted almost seven in ten relied on the designers for product recommendations and half for design and color/finish recommendations.

The total revenue of wood kitchen cabinet and countertop manufacture in Canada is expected to reach $2.905 billion (USD) in 2018. That number is projected rise to $2.932 billion in 2019 and $2.954 billion in 2020, according to information from Statista. (NAICS/SCIAN 33711).

In 2016, the total salaries in the Canadian wood kitchen cabinet and countertop industry reached $1.1 billion, increasing from $983.3 million in 2015 or by 11.9%, according to Statistics Canada, Annual Survey of Manufactures and Logging.

The home remodeling market is estimated by The Freedonia Group to be $69 billion.

Global demand for countertops is projected to rise 2.3% annually through 2021, to nearly 500 million square meters, according to the study Global Countertops by Material, Market and Type, by The Freedonia Group. Strong advances in developing markets such as China, India, and Brazil will account for the majority of demand, with the kitchen market accounting for the majority of demand. Solid surface continues to be a global favorite, with engineered stone fast tracking upward due to its style and durability.

Market Data Sources: The Freedonia Group, Kitchen Cabinet Manufacturers Assn. (KCMA), National Kitchen & Bath Assn. (NKBA), Canadian Kitchen Cabinet Assn. (CKCA), Cabinet Makers Assn. (CMA), FDMC, Houzz, Statistics Canada/StatCan, RICKI, Statista, U.S. Census Bureau, Government of Canada-Innovation, Science & Economic Development

Category: Cabinets & countertops include: kitchen cabinetry, bath cabinetry, vanities, countertops and islands.

Have something to say? Share your thoughts with us in the comments below.