Global Timber Markets

• The Global Sawlog Price Index (GSPI) increased by 1.5 percent to US$83.52/m3 in the 4Q/12 after having declined for five consecutive quarters. This time marked the longest period of continuous decline since the Index was established in 1995, falling continuously from the all-time-high in the 2Q/11 through the 3Q/12. Log prices were up in US dollar terms in practically all 17 regions that are included in the GSPI.

Global Pulpwood Prices

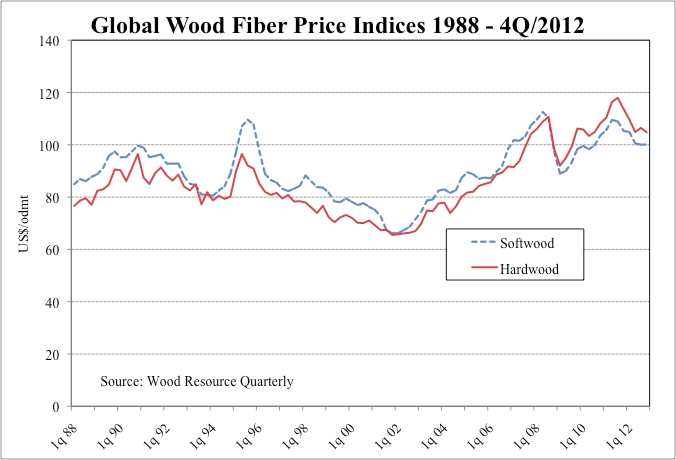

• Wood fiber prices trended downward in the local currencies in many of the key pulpproducing countries of the world in the fourth quarter. The declines were mainly the result of an increased supply of softwood fiber in regions with extensive lumber production.

• As a result of a weakening US dollar, conifer fiber prices actually increased in US dollar terms in a number countries and the Softwood Wood Fiber Price Index (SFPI) was up slightly (+0.1%) in the 4Q/12 to $100.13/odmt. The biggest increases from the 3Q to the 4Q occurred in Eastern Canada, Finland, France and New Zealand.

• Hardwood fiber price movements were mixed, with hardwood log prices generally trending downward in many of the key hardwood pulp producing regions in both local currencies and in US dollar terms. This resulted in a decline in the Hardwood Wood Fiber Price Index (HFPI) to US$104.80/odmt in the 4Q/12. This was down 1.5 percent from the previous quarter and 7.8 percent from the 4Q/11.

Global Pulp Markets

• After market pulp production fell during the first six months of 2012, the bottom was reached during the summer and the trend turned upward in the fall. In December, world production was estimated to be slightly over eight percent higher than in December of 2011, according to Hawkins Wright Ltd.

• There has been much uncertainty in the global pulp market the past 12 months, with contract prices fluctuating and price discounts for spot volumes entering into the 20- 25 percent range. Market pulp prices moved up in the 4Q/12 after having declined during the 3Q, and this upward trend continued into early 2013.

Global Lumber Markets

• Global trade of softwood lumber fell in 2012 by an estimated 2.5 percent with practically all of the major lumber-consuming countries reducing importation. This decline came after two years of increased trade.

• Lumber production in the US improved throughout 2012 with total output for the first 11 months being eight percent higher than the same period in 2011, according to WWPA.

• The US lumber price development the past year has been quite remarkable. From late 2011 to February 2013, the Southern Yellow Pine lumber price increased 80 percent.

• Softwood lumber importation to China was lower in 2012 than in 2011. However, towards the end of 2012, housing activities and demand for lumber picked up and 4Q lumber imports were up seven percent from the 3Q/12.

• The trend for lumber imports to Japan has developed similarly to that of China with less import in 2012 than 2011, but an increase towards the end of the year. In the 4Q/12, Japan imported just over 1.6 million m3, which was the highest quarterly import volume of the year.

• The export market improved for Nordic sawmills during the 4Q/12 with shipments up substantially from the previous quarter. The biggest increases in shipments occurred in the United Kingdom, Northern Africa and Japan

Global Biomass Markets

• Pellet exports from the two primary pellet-producing regions on the North American continent, the US South and British Columbia, continued to increase in the 3Q/12, reaching a new record high of 860,000 tons. Shipments in the 3Q/12 were over 70 percent higher than the same quarter in 2011

• Over three million tons of new pellet-export facility capacity was announced during the second half of 2012.

• As a result of the increased demand for pellets both domestically in Germany and from the export market, pellet prices in the 4Q/12 moved up to the highest level since 2006.

Global timber market reporting is included in the 52-page quarterly publication Wood Resource Quarterly. The report, established in 1988 and with subscribers in over 25 countries, tracks sawlog, pulpwood, lumber and pellet prices, and market developments in most key regions around the world. To subscribe to the WRQ, please go to www.woodprices.com

Source: Wood Resources International LLC

Have something to say? Share your thoughts with us in the comments below.