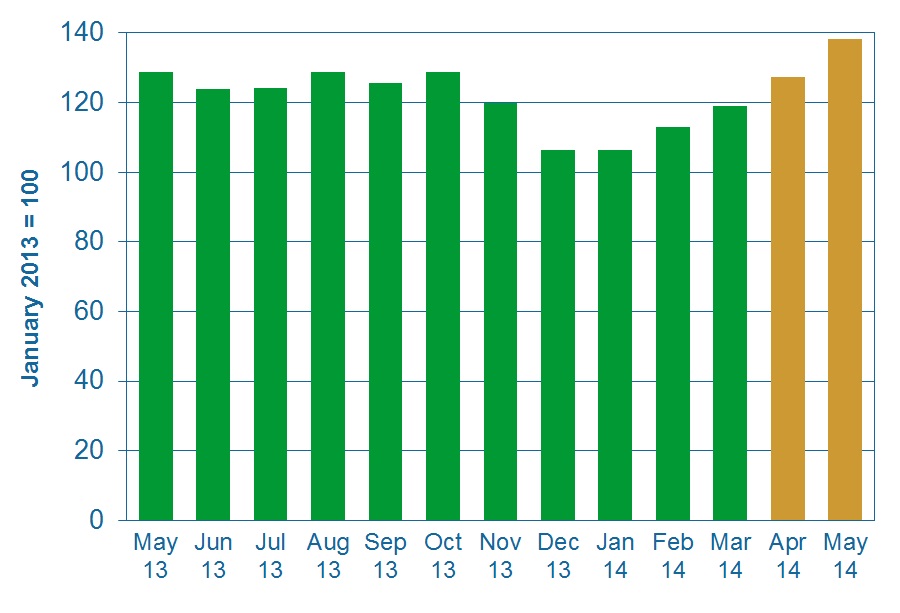

The Weekly Hardwood Review Leading Hardwood Demand Indicator (LHDI)—a forecast of future demand for U.S. hardwood lumber based on residential and commercial construction, import/export trends, inflation levels, and job markets— trends up from a reading of 119.0 in March to 127.2 in April to a record high of 138.2 in May (Jan 2013=100) on spring bumps in remodeling activity and non-residential construction, improving jobs markets, and expectations of record exports to Asia.

The Weekly Hardwood Review Leading Hardwood Demand Indicator (LHDI)—a forecast of future demand for U.S. hardwood lumber based on residential and commercial construction, import/export trends, inflation levels, and job markets— trends up from a reading of 119.0 in March to 127.2 in April to a record high of 138.2 in May (Jan 2013=100) on spring bumps in remodeling activity and non-residential construction, improving jobs markets, and expectations of record exports to Asia.

Hardwood lumber producers reported strong sales in recent weeks. Most attributed the strength more to a lack of supply than robust demand. Lumber prices continue to firm, but sellers noted more resistance from customers to the higher prices.

Some warnings were voiced. For example, one veteran lumberman said, “Big changes are coming as weather improves and more lumber becomes available.” Some customers, however, are still ordering lumber two to three months in advance “priced time of shipment.”

Export demand was good, and one exporter said that customers who turn down the first price often return to place the order. Sawmills aren’t producing or shipping pallet cants, pallet lumber, frame stock, crossties, switchties, crane mats, board road and industrial timbers fast enough to suit buyers.

Have something to say? Share your thoughts with us in the comments below.