JASPER, IN--Kimball International, Inc. today reported net sales of $314.5 million and net income of $3.3 million, or $0.09 per Class B diluted share, for the third quarter of fiscal year 2011 which ended March 31, 2011.

Consolidated Overview

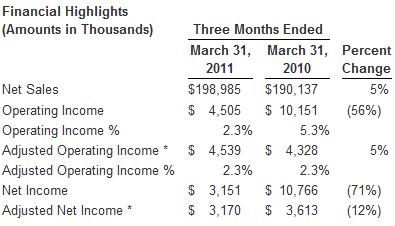

* Items indicated represent Non-GAAP measurements. See âReconciliation of Non-GAAP Financial Measuresâ below.

* Consolidated net sales in the third quarter of fiscal year 2011 increased 11% on net sales increases of 25% in the Furniture segment and 5% in the Electronic Manufacturing Services (EMS) segment. Sequentially, consolidated net sales in the third quarter of fiscal year 2011 increased 1% over the most recent second quarter as a 10% increase in net sales in the EMS segment was mostly offset by a seasonal 11% decline in net sales in the Furniture segment.

* Third quarter gross profit as a percent of net sales improved 1.8 percentage points from the prior year third quarter on improved margins in both segments.

* Consolidated third quarter selling and administrative expenses increased 4% compared to the prior year primarily due to higher commissions associated with increased sales levels, increased spending on sales and marketing initiatives to drive growth, and higher labor costs. As a percent of net sales, fiscal year 2011 third quarter consolidated selling and administrative expenses declined 1.1 percentage points compared to the prior year on the leverage from the higher sales volumes.

* Other General Income of $6.7 million in the prior year third quarter resulted from the sale of the Company's land and facility in Poznan, Poland that housed its Poland operation before moving to another facility in Poland. The Company did not have any Other General Income in the current year third quarter.

* Other Income/Expense for the third quarter of fiscal year 2011 was income of $0.9 million compared to income of $0.5 million in the prior year third quarter.

* The Company's effective tax rate for the third quarter of fiscal year 2011 was 29%. In the prior year third quarter, the Company's effective tax rate was (282%) resulting from a tax benefit related to the sale of the land and facility in Poland and a favorable impact of the Company's earnings mix between U.S. and foreign jurisdictions.

* Operating cash flow for the third quarter of fiscal year 2011 was a cash inflow of $13.4 million compared to an operating cash outflow of $6.7 million in the third quarter of the prior year.

* The Company's cash and equivalents less short-term borrowings declined to $35.4 million at March 31, 2011 compared to $65.3 million at June 30, 2010 primarily due to the increased working capital requirements to support the higher sales volumes. Long-term debt including current maturities is $0.3 million.

James C. Thyen, Chief Executive Officer and President, stated, âThe Furniture market has experienced steady growth over the last several quarters with certain segments of the market providing better opportunities for growth. We took advantage of the market growth, increasing our third quarter sales in this segment by 25% over the prior year. Our EMS segment enjoyed record sales in the third quarter, as our long-term customer relationships and our ability to execute to the highest quality and reliability expectations in the industry continues to drive our success. The record sales translated to significant improvement in our EMS segment third quarter operating profit over the first half of this fiscal year. Winning new projects in all markets remains intensely competitive, and as expected continues to put pressure on our margins.â

Mr. Thyen concluded, âLooking forward, we are closely monitoring our EMS customers and suppliers affected by the tragic earthquake and tsunami in Japan. While we have experienced minimal disruption in our supply chain to this point, we have been informed by some suppliers of possible component shortages in the near future. On the customer side, we are seeing some reduction in our order requirements over the next quarter. The short-term outlook is very fluid. Once suppliers regain full capacity and capability, we anticipate there will be increased demand to recover the lost production.â

Electronic Manufacturing Services Segment

* Items indicated represent Non-GAAP measurements. See âReconciliation of Non-GAAP Financial Measuresâ below.

* Fiscal year 2011 third quarter net sales in the EMS segment increased 5% over the third quarter of the prior year with increased net sales to customers in the medical and industrial control industries partially offset by declines in net sales to customers in the automotive and public safety industries. Compared to the fiscal year 2011 second quarter, current year third quarter net sales increased 10% on growth in the medical, automotive and industrial control markets.

* Gross profit as a percent of net sales in the EMS segment for the third quarter of fiscal year 2011 increased 0.3 percentage points when compared to the third quarter of the prior year.

* Selling and administrative costs in this segment increased 8% in the fiscal year 2011 third quarter when compared to the prior year partly related to increased labor costs. As a percent of net sales, selling and administrative costs increased slightly in the current year third quarter when compared to the prior year.

* The previously mentioned fiscal year 2010 third quarter $6.7 million pre-tax gain and associated tax benefit resulting from the sale of the Company's Poland land and facility was recorded in the EMS segment.

* Operating income excluding the Poland land/facility gain and restructuring charges in the EMS segment increased from $4.3 million in the third quarter of fiscal year 2010 to $4.5 million in the third quarter of fiscal year 2011 on the higher sales volume and improved gross margins.

Furniture Segment

* Fiscal year 2011 third quarter net sales of furniture products increased 25% compared to the prior year on increased net sales of both office and hospitality furniture. Sequentially, third quarter fiscal year 2011 net sales in this segment decreased 11% over the second quarter of fiscal year 2011 on the normal seasonal slowdown.

* Gross profit as a percent of net sales improved 2.7 percentage points in the Furniture segment in the third quarter of fiscal year 2011 when compared to the prior year primarily due to fixed cost leverage gained on increased sales volumes, price increases on select product, and labor efficiencies. Partially offsetting these gains were increased price discounting on select product due to competitive pricing pressures.

* Selling and administrative costs in this segment for the third quarter of fiscal year 2011 increased 5% when compared to the prior year on higher commissions associated with the increased sales levels and higher costs associated with sales and marketing initiatives to drive growth. As a percent of net sales, fiscal year 2011 third quarter selling and administrative expenses declined 5.3 percentage points compared to the prior year on the leverage from the increase in net sales.

* The Furniture segment recorded operating income of $0.2 million during the third quarter of fiscal year 2011, a significant improvement from the $(7.2) million loss in the prior year third quarter.

Non-GAAP Financial Measures

This press release contains non-GAAP financial measures. A non-GAAP financial measure is a numerical measure of a company's financial performance that excludes or includes amounts so as to be different than the most directly comparable measure calculated and presented in accordance with Generally Accepted Accounting Principles (GAAP) in the United States in the statement of income, balance sheet or statement of cash flows of the Company. The non-GAAP financial measures on a consolidated basis used within this release include 1) operating income(loss) excluding Poland land/facility gain and restructuring charges, 2) net income (loss) excluding Poland land/facility gain and restructuring charges, and 3) earnings (loss) per Class B diluted share excluding Poland land/facility gain and restructuring charges. The non-GAAP financial measures on a segment basis used within this release include 1) operating income excluding Poland land/facility gain and restructuring charges and 2) net income excluding Poland land/facility gain and restructuring charges. Reconciliations of the reported GAAP numbers to these non-GAAP financial measures are included in the Financial Highlights table below. Management believes it is useful for investors to understand how its core operations performed without the effects of the gain on the Poland land/facility sale and costs incurred in executing its restructuring plans. Excluding the gain and restructuring charges allows investors to meaningfully trend, analyze, and benchmark the performance of the Company's core operations. Many of the Company's internal performance measures that management uses to make certain operating decisions exclude these charges and non-operating income to enable meaningful trending of core operating metrics.

Conference Call / Webcast

Kimball International will conduct its third quarter financial results conference call beginning at 11:00 AM Eastern Time today, May 5, 2011. To listen to the live conference call, dial 866-711-8198, or for international calls, dial 617-597-5327. The pass code to access the call is "Kimball". A webcast of the live conference call may be accessed by visiting Kimball's Investor Relations website.

For those unable to participate in the live webcast, the call will be archived online within two hours of the conclusion of the live call and will remain there for approximately 90 days. A telephone replay of the conference call will be available within two hours after the conclusion of the live event through May 19, 2011, at 888-286-8010 or internationally at 617-801-6888. The pass code to access the replay is 76797836.

About Kimball International, Inc.

Recognized with a reputation for excellence, Kimball International is committed to a high performance culture that values personal and organizational commitment to quality, reliability, value, speed and ethical behavior. Kimball employees know they are part of a corporate culture that builds success for Customers while enabling employees to share in the Company's success through personal, professional and financial growth.

Kimball International, Inc. provides a variety of products from its two business segments: the Electronic Manufacturing Services segment and the Furniture segment. The Electronic Manufacturing Services segment provides engineering and manufacturing services which utilize common production and support capabilities to a variety of industries globally. The Furniture segment provides furniture for the office and hospitality industries sold under the Company's family of brand names.

Financial Highlights for the third quarter ended March 31, 2011, follow:

Have something to say? Share your thoughts with us in the comments below.