Major Players

ASHLEY FURNITURE

HERITAGE HOME GROUP (formerly Furniture Brands)

LA-Z-BOY

ETHAN ALLEN

FLEXSTEEL

RESHORING BUSINESS

BUSINESS Dovetailing on the uptick in the housing and remodeling markets, consumer spending for furniture and bedding products grew modestly to $93.9 billion in 2012.

The reshoring efforts by domestic manufacturers is helping slow the tide of imports and grow business. Although imports accounted for 62.7% of total household furniture sold in the U.S. in 2011, it looks to decrease in the coming years as U.S. manufacturers ramp up business and become more price competitive.

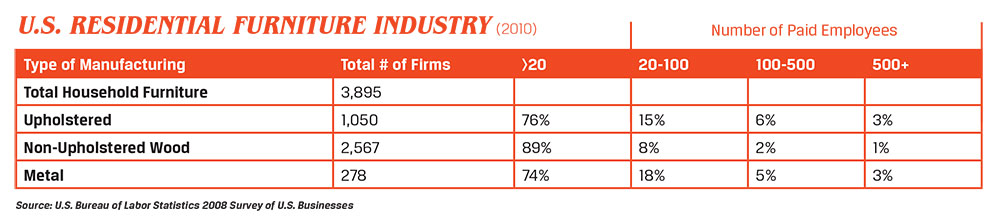

In addition to low-cost imports, furniture flammability, formaldehyde emissions and sustainability/ Lacey Act are among the issues impacting the estimated 4,000 manufacturing firms.

In addition to low-cost imports, furniture flammability, formaldehyde emissions and sustainability/ Lacey Act are among the issues impacting the estimated 4,000 manufacturing firms.

DESIGN The recent High Point Market featured a number of styles, including a continuing trend for lighter, modern-looking pieces. For casegoods, these include clean lines, lighter tones mixed with contrasting hues, and even some splashes of color. Custom finishes from domestic manufacturers are also more evident than before.

| Sources: American Home Furnishings Alliance; Mann, Armistead & Epperson; U.S. DOC, U.S. Dept. of Labor, U.S. Census Bureau, Furniture Today | The American Home Furnishings Alliance’s 350 members include domestic and import operations. | Domestic furniture makers have a key advantage: proximity to the downstream market. | In 2012, Canada’s furniture industry consisted of 6,612 firms, with most in Ontario and Quebec. |

|

Have something to say? Share your thoughts with us in the comments below.