Following a “rollercoaster” 2011, the components industry is forecasting moderate to good sales growth for 2012, from 3 to 10 percent or more, according to member surveys by the Wood Component Manufacturers Assn. (WCMA) and the Wood Products Manufacturers Assn. (WPMA).

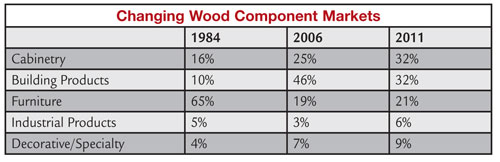

“Since building products was the largest end-use category for wood components until the fall-off of the housing market in 2008, this market segment could easily regain its lead with recovery in the housing and remodeling sectors,” said Steve Lawser executive director of the WCMA “Cabinetry could also post a comeback as well in the remodeling areas as people continue to upgrade their homes rather than purchasing new homes.” Lawser said members are also seeing a resurgence in demand by the furniture industry.

“Since building products was the largest end-use category for wood components until the fall-off of the housing market in 2008, this market segment could easily regain its lead with recovery in the housing and remodeling sectors,” said Steve Lawser executive director of the WCMA “Cabinetry could also post a comeback as well in the remodeling areas as people continue to upgrade their homes rather than purchasing new homes.” Lawser said members are also seeing a resurgence in demand by the furniture industry.

Phil Bibeau, WPMA executive director, concurred. “A number of members are supplying component parts to U.S.-based furniture manufacturers that are able to deliver a highly customized product, in smaller quantities, and with a shorter lead time than an imported product. We are hearing from more and more companies that are saying they have been manufacturing their product overseas, and now with all the quality problems, required travel to correct manufacturing problems, long lead times, increases in freight and insurance rates, coupled with rising labor costs, it is no longer advantageous to manufacture in Asia. More and more, companies are specifying the product to be made in the USA.

But with increased sales opportunities come challenges. Both Lawser and Bibeau said lack of available credit, a still-recovering economy, low-cost products from foreign competitors and increased usage of non-wood materials for components — i.e., plastics, metals, glass, ceramic, stone — is taking market share away from wood components.

“Some other concerns for 2012 are the reduction in sawmill capacity, which could lead to supply shortages; slow or non-paying accounts; increased shipping costs; and higher energy costs that have resulted in higher production costs. These higher product costs are difficult to pass on to consumers in our current price competitive markets,” Lawser added.

Have something to say? Share your thoughts with us in the comments below.