Editor's Note: This story originally posted on April 6, has been updated.

The Canadian government raced to approve the COVID-19 Economic Response Plan on March 25. The wide-sweeping emergency bill provides nearly $100 billion in financial aid to businesses, families and individuals affected by the coronavirus pandemic. That includes secondary wood product manufacturers, industry suppliers and their employees impacted by the escalating coronavirus pandemic.

According to the World Health Organization, reported COVID-19 cases passed 2.16 million worldwide on April 19 including 146.088 deaths. As of that same date, Canada had 34,786 confirmed cases resulting in 1,580 deaths. Quebec accounted for 18,357 cases and 877 deaths followed by Ontario - 10,578 cases and 553 deaths.

According to Statistics Canada, one million Canadians had applied for unemployment benefits as of April 1 bringing the nation's unemployment rate to 5.9%. The jobless numbers are expected to spike in April report. Approximtaely 6 million Canadians applied for the Canada Emergency Response Benefit. The CERB program provides $500 per week for up to 16 weeks to Canadians financially impacted by the pandemic.

The CERB is a cornerstone of Canada’s COVID-19 Economic Response Plan which also includes, a new loan program for businesses, and deferred payment deadlines for income tax and GST/HST. In addition, each of Canada’s 10 provincial governments has approved rescue packages of varying types to assist its respective businesses and residents.

Following are summaries of national and provincial COVID-19 relief programs, including links for finding additional information and resources.

CANADA: Main COVID-19 Resources Page

|

| Read about all 50 U.S. states' COVID-19 relief programs. |

Support for Businesses:

- The Canada Emergency Wage Subsidy will cover 75 percent of salaries for qualifying businesses for up to three months, retroactive to March 15, 2020. Employers of all sizes and across all sectors of the economy would be eligible with the exception of public sector entities.

- Organizations that do not qualify for the Canada Emergency Wage Subsidy may qualify for the wage subsidy of 10 per cent of remuneration paid from March 18 to before June 20, 2020.

- The maximum duration of the Work-Sharing program has been extended from 38 weeks to 76 weeks. The Work-Sharing program is offered to workers who agree to reduce their normal working hours because of developments beyond the control of their employers.

- The Business Credit Availability Program provides $40 billion of additional support through the Business Development Bank of Canada and Export Development Canada. The program includes loan gaurantees up to $6.25 million for small and medium-sized enterprises.

- All businesses are being allowed to defer, until after Aug, 31, the payment of any income tax amounts that become owing on or after March 18 and before September 2020. This relief would apply to tax balances due, as well as instalments, under Part I of the Income Tax Act.

- No interest or penalties will accumulate on these amounts during this period.

Support for Workers:

- The Canada Emergency Response Benefit provides $500 a week for up to 16 weeks for employees and self-employed individuals who have stopped working because of COVID-19. Participants must have earned $5,000 in 2019 or the past 12 months to qualify.

- New employee sickness benefits are availabled to individual who are sick or quarantined because of COVID-19. Participants to not have to be eligible for employment insurance to qualify. The benefit is available from March 14 to Oct. 3.

- The government is working with the banks to offer customers solutions to help customers manage hardships caused by COVID-19 on a case-by-case basis. This includes permitting lenders to deger up to six monthly mortgage payments for impacted borrowers.

Essential Businesses: The Canadian government has developed guidelines for critical services, some of which are superceded by individual provinces. The list includes workers who support the manufacture and distribution of forestry products, including, but not limited to timber, paper, and other wood products.

Help Combat COVID-19: Businesses and individuals can learn how to support Canada’s whole-of-government response to Coronavirus disease (COVID-19).

ALBERTA: Main COVID-19 Resource Page

Support for Businesses:

- Alberta's Business Continuity Plan describes how an organization will continue to function during or after some kind of emergency, disaster or event. It involves planning how key services or products can be continued, and the recovery of key business and systems.

- Invoices for 2020 loan premiums have been stopped for the remainder of the year through the ATB Financial customer relief program. Payments already made towards 2020 premiums will be automatically refunded to employers. The estimated total value of loans to qualifying businesses and consumers is $3.6 billion.

- Alberta corporate income tax balances and installment payments coming due between March 18 and Aug. 31, 2020 are deferred until August 31, 2020 to increase employers’ access to cash so they can pay employees, address debts and continue operations.

- Private sector employers can defer premium payments to the Worker’s Compensation Board until 2021. The government will cover 50% of the 2020 premium for small and medium employers when it is due in 2021 – saving businesses $350 million. Large employers will have their 2020 WCB premium payments deferred until 2021, at which time their premiums will be due. Employers who have already paid WCB premiums in 2020 are eligible for a rebate or credit.

Support for Workers:

- Residential, farm and small commercial customers can call their utilities to defer electricity and natural gas bill payments for the next 90 days to ensure no one will be cut off, regardless of the service provider.

- Changes to the Employment Standards Code allow all full and part-time employees to take 14 days of job-protected leave if they are required to self-isolate or caring for a child or dependent adult who is required to self-isolate due to COVID-19. No medical note is required. The leave does not apply to self-employed individuals or contractors.

- Employees may consider applying for federal Employment Insurance benefits. They allow up to 15 weeks of assistance if a person cannot work due to medical reasons such as self-isolation or self-quarantine.

Essential Businesses: The province's list of essential services includes those that manufacture, process and distribute goods, products, equipment and materials, including businesses that manufacture components to other manufacturers.

Help Combat COVID-19: Alberta's Bits and Pieces Program seeks support from companies and organiztions for products or services.

BRITISH COLUMBIA: Main COVID-19 Resources Page

Support for Businesses:

- B.C. has extended filing and payment deadlines for employer health, sales and other taxes until Sept. 30.

- Guidance is available to employers for handling absences and other disruptions including job-protected leaves, temporary layoffs and group terminations.

- B.C. plans $1.5 billion in provincial funding to support economic stimulus after the pandemic has passed.

Support for Workers:

- The B.C. Emergency Credit for Workers provides a one-time $1,000 payment to people who lost income because of COVID-19. B.C. residents who receive federal Employment Insurance, or the new federal Canada Emergency Response Benefit are eligible. Applications for the one-time payment will open soon.

- A one-time enhancement to the non-taxable climate action tax credit will be paid in July 2020 for moderate to low-income families. An adult will receive up to $218 (increased from $43.50) and a child will receive $64 (increased from $12.75).

- The website also includes information for applying to unemployment benefits; relief for housing rents/mortgages and utilities and unpaid job-protected leave rules related to COVID-19.

Essential Businesses: Included are businesses that manufacture and distribute pallets and crates and businesses that supply primary and value-added forestry/silviculture products such as lumber, pulp, paper and wood fuel. The list of businesses considered non-essentials includes construction firms, skilled trades, and construction and light industrial machinery and equipment rental.

Help Combat COVID-19: The B.C. Government is looking for both medical and non-medical products and services to help with the response.

MANITOBA: Main COVID-19 Resource Page

- The Manitoba government has amended rules in the provincial employment standards regulations to allow employers to furlough employees for a longer period without having to be permanently let go.

- Manitoba Hydro, Centra Gas and Manitoba Public Insurance (MPI) have been instructed to not charge interest or penalties in the event that Manitobans are unable to pay at this time until Oct. 31. The government is also deferring provincial income tax and corporate income tax filing deadlines and payments to coincide with the current revised federal deferral of income tax to Aug. 31 and has indicated it would be willing to extend these deferrals until Oct. 1, should the federal government agree.

- Available Workplace FAQs include what to do if an employee displays COVID-19 symptoms and how to protect COVID-19 spread.

Support for Workers: Included are FAQs of Workers Compensation Board’s guidelines on work-leave coverages and claims due to COVID-19-related illnesses.

https://www.wcb.mb.ca/how-the-wcb-is-responding-to-covid-19#worker

Essential Businesses: Manitoba includes the construction industry and businesses that manufacture or process goods or materials, including component manufacturers as critical businesses that can continue to operate.

Help Combat COVID-19: Manitoba Combat COVID-19 submission form.

NEW BRUNSWICK: Main COVID-19 Resource Page

- Though business property taxes must be paid by May 31, late penalties will be reviewed on a case-by-case basis to see if the penalty can be waived due to undue financial challenges, such as having to close a business due to COVID-19.

- On a case-by-case basis, New Brunswick will defer loan and interest repayments for up to six months on existing provincial loans.

- New Brunswick will provide small businesses impacted by COVID-19 with working capital via loans up to $100,000.

- Opportunities New Brunswick will make available support mid-to-large sized employers via working capital in excess of $100,000 to help manage the impacts of COVID-19 on their operations.

Support for Workers: The New Brunswick Workers Emergency Income Benefit provides one-time income benefit of $900 is available for workers or self-employed people residing in New Brunswick who have lost their job due to the state of emergency. It is available until April 30.

Essential Businesses: New Brunskwick’s Declaration of a State of Emergency and Mandatory Order lists production and manufacturing facilities among those that may remain open.

NEWFOUNDLAND AND LABRADOR: Main COVID-19 Main Resource Page

The province's website features general information about COVID-19, including guidelines for social distancing and other best-practices for a safeguarding against the virus are included on the website. Also available is “Risk-Informed Decision Making Guidance for Construction Sites Operating During COVID-19” and numerous downloadable COVID-19 informational posters for displaying in manufacturing and other business environments.

Essential Businesses: Includes all non-retail operations provided workers can maintain social distancing.

NOVA SCOTIA: Main COVID-19 Resource Page

Support for Businesses:

- To aid small and medium-sized businesses, landlords are encouraged to defer rent payments from their commercial tenants for three months, spreading the deferred rent amount over the rest of the lease term. Landlords are not permitted to change locks or seize property of businesses who cannot pay rent, if the business closed directly because of COVID public health orders.

- Through the new $20-million Small Business Impact Grant program, eligible businesses will receive a grant of 15 percent of their revenue from sales, either from April 2019 or February 2020, up to a maximum of $5,000. This flexible, one-time, upfront grant can be used for any purpose necessary.

Support for Workers:

- Nova Scotia is contributing $20 million to help self-employed people and laid-off workers who don’t qualify for Employment Insurance. Government will provide a one-time payment of $1,000 to bridge the gap between layoffs and closures and the federal government’s Canada Emergency Response Benefit.

- Every individual and family member on income assistance will receive an additional $50 starting Friday, March 20 March. People do not need to apply.

Essential Businesses: Any workplace or business that is not deemed essential can remain open as long as a two-metre or six-foot distance can be maintained. Workspaces must also be cleaned and disinfected at a minimum of twice daily or as required and employees follow proper hygiene.

ONTARIO: Main COVID-19 Resource Page

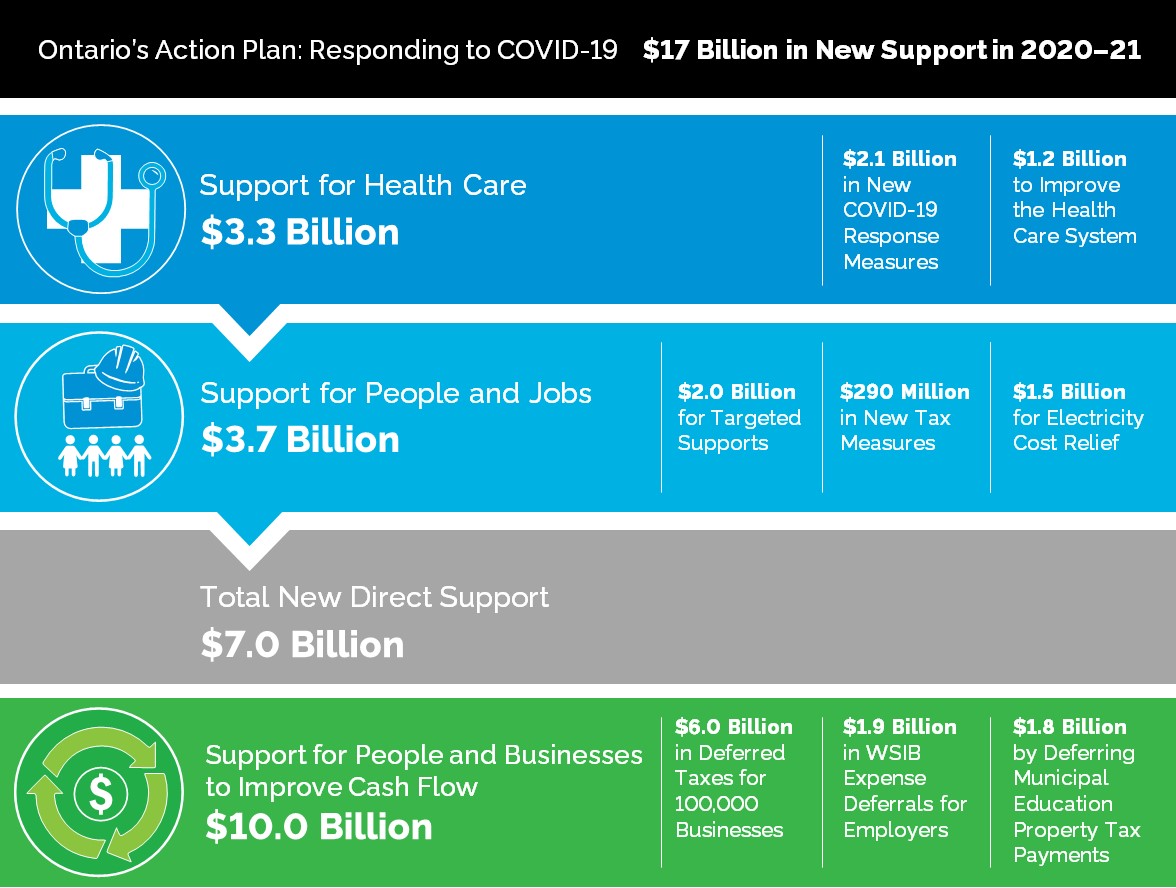

Ontario’s Action Plan: Responding to COVID‑19 outlines the government’s $17 billion response to support the province’s health care system, communities and economy.

Support for Businesses:

Support for Businesses:

- Ontario businesses unable to file or remit their provincial taxes (including employer health tax, gas tax, etc.) on time due to COVID-19 will not be penalized or incur interest charges between Apr. 1 and Aug. 31.

- The Employer Health Tax exemption for 2020 was increased from $490,000 to $1 million due to the special circumstances caused by the coronavirus (COVID-19) in Ontario. This exemption increase is designed to provide tax relief for businesses so that they can focus on supporting the well-being of their employees and their continued operations during this time of uncertainty.

- Businesses are receiving a five-month interest and penalty-free period to make payments for the majority of provincially administered taxes, representing an estimated $6 billion in relief.

- An estimated $1.9 billion in new financial relief by the Workplace Safety and Insurance Board (WSIB) allows employers to defer payments for a period of six months. All employers covered by the WSIB’s workplace insurance are automatically eligible for the financial relief package.

Support for Workers:

- The province passed legislation to provide job-protected leave to employees in isolation or quarantine, or those who need to be away from work to care for children because of school or daycare closures due to the COVID‑19 outbreak.

- $100 million in funding has been committed through Employment Ontario for skills training programs for workers affected by the COVID‑19 outbreak.

- The province is working with the federal government to find ways to support apprentices and enable businesses to continue to retain these skilled trades workers during the COVID‑19 outbreak.

Essential businesses: The list includes manufacturers that process and distribute goods, products, equipment and materials, including businesses that manufacture components for other manufacturers regardless of whether those other manufacturers are inside or outside of Ontario. A litany of construction project types considered essential include buildings for the healthcare industry. Residential construction projects are covered if a footing permit has been granted; an above grade structural permit has been granted for multi-story condominiums, or the project involves renovations to residential properties and construction work was started before April 4, 2020.

Help Combat COVID-19: The Ontario Together Fund includes $50 million to support submissions that can be acted on quickly. The funds will help companies retool, build capacity or adopt the technological changes needed to produce supplies and equipment for hospitals, long-term care homes and other critical public services. Ideas, products and services to combat COVID-19 also are welcome.

PRINCE EWARD ISLAND: Main COVID 19 Resource Page

Support for Businesses:

- The COVID-19 Special Situation Fund for businesses and organizations will provide funding to businesses, community groups and non-government organizations that have experienced urgent income loss as a result of COVID-19 and are not eligible for other federal and provincial funding support. The application deadline is April 15.

- The COVID-19 Business Adaptation PROGRAM provides a non-repayable contribution of up to $2,500 toward the cost of hiring a professional service to provide advice and support to adapt to or recover from the impacts of COVID-19. Eligible applicants can obtain business, human resources and financial planning and advice.

Support for Workers:

- The Prince Edward Island COVID-19 Income Support Fund provides a one-time lump sum payment of $750 for individuals who earned at least $5,000 gross wages over the last 12 months and lost their job or were laid off since March 13. Self-employed individuals who has lost all revenues are also covered. The emergency income is taxable. The application deadline is April 30.

- The COVID-19 Special Situations Fund for Individuals will provide financial assistance to $1,000 to Islanders who have experienced urgent income loss as a result of COVID-19 and are not eligible for other federal and provincial funding support. Individuals may be eligible for up to $1000 between March 16 and June 16, 2020.

- The Government of Prince Edward Island has partnered with Sobeys on the PEI Employee Gift Card Program. This is a temporary program put in place to offer a $100 Sobeys gift value to any employee, living and working on Prince Edward Island, who has received a ROE as lay-off notice as a direct result of the impacts associated with COVID-19 between March 13 and 31.

- The Temporary Rental Assistance Benefit will provide $1,000 per household to help cover the cost of rent for a three-month period. Eligible Islanders will receive $500 in the first month and $250 the following two months.

Essential Businesses: "Essential services" means services that the interruption of which would endanger the life, health or personal safety of the whole or part of the population. The list of essential services includes industrial manufacturing.

QUEBEC: Main COVID-19 Resource Page

- Support for Businesses: The Concerted Temporary Action Program for Businesses is an emergency funding measure providing government loans to help shore up the working capital of businesses operating in Quebec affected by the repercussions of COVID-19. Eligible businesses include those experiencing difficulties obtaining supplies of raw materials or products (goods or services) or whose ability to deliver products is halted or reduced. The minimum funding amount is $50,000.

Support for Workers: The Temporary Aid for Workers Program offers a lump-sum payment of $573 per week for workers who cannot earn all of their work income because of a need to self-isolate for 14 days to counter the propagation of the COVID-19 virus. If justified by the worker’s state of health, the coverage period for an eligible person could be extended to a maximum of 28 days. An “eligibility tool” is included.

Essential businesses: Food production, pulp and paper, micro-electronic components and manufacturing in the defense sector are classified as “high-priority activities.” Initially Quebec considered woodworking as non-essential, although a wood products company could request a waiver if it manufactures products needed by the healthcare industry, for example. The list was subsquently amended to include wood products manufacturing as essential. Effective of April 20, Quebec is easing limits on home construction. "Work to complete the delivery of residential units slated for not later than July 31, 2020 will be authorized. This includes construction and renovation work and surveying and building inspection. As a result, the construction industry supply chain sector, comprising numerous SMEs, will reopen." In addition, residential renovation projects that were started or planned before March 24, can proceed so long as they are completed by July 31.

SASKATCHEWAN: Main Resource Page

- Information to offered to help manage staffing, work-sharing, layoffs and leave.

- Saskatchewan businesses which are unable to remit their provincial sales tax due to cashflow concerns will have three-month relief from penalty and interest charges. In addition, all Crown utilities will implement bill-deferral programs allowing a zero-interest bill deferral for up to six months for Saskatchewan customers whose ability to make bill payments may be impacted by the COVID-19 restrictions.

- The Saskatchewan Workers’ Compensation Board (WCB) is introducing relief measures for employers who are unable to pay their WCB premium payments, including waiving penalites and interest cjarges for late premium payments through June 30.

- The Self-Isolation Support Program is targeted at Saskatchewan workers forced to self- isolate in order to curb the spread of COVID-19, and who are not covered by recent federally announced employment insurance programs and other supports. Administered by the Ministry of Finance, the program will provide $450 per week, for a maximum of two weeks or $900.

- Saskatchewan’s amended job protected leave measures grant employees unpaid public health emergency leave; remove the requirement of 13 consecutive weeks of employment with an employer prior to accessing sick leave; and removing the provision requiring a doctor's note or certificate.

Essential Businesses: Includes production, processing and supply chains of the forestry and manufacturing sectors.

Have something to say? Share your thoughts with us in the comments below.