Even though export growth slowed at year-end, total U.S. hardwood lumber exports in 2012 fell just four-tenths of one percent shy of the 2006 record.

Chinese economic growth is back on track and with both Asian and Mexican demand trending higher, 2013 exports should easily set a new record, even if European buying remains stagnant for another year. The wild card is whether or not exporters will have enough lumber to ship, as some have already had to turn down orders.

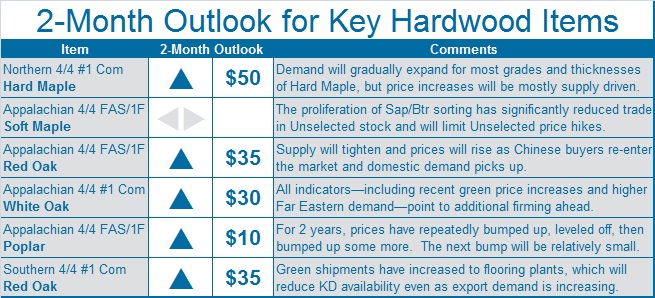

At the same time, domestic lumber markets will continue to improve, though only the flooring sector is currently firing on all cylinders. As rising home construction and remodeling activity slowly spill up and out of the starter home and foreclosure arenas this summer into larger single-family homes, we should finally see the sustained pull of new demand for cabinets, furniture, moulding and millwork. Sawmills will struggle against tight credit and high log costs just to maintain production levels, however, setting the stage for a full year of tight lumber supplies and firm pricing.

If history repeats itself, imported flooring, furniture and moulding will compete aggressively on price for expanding U.S. consumer markets. Flooring imports rose 15% in 2012 to a record 407 million ft2, wood furniture imports climbed 6%, and hardwood moulding imports jumped 17%.

Have something to say? Share your thoughts with us in the comments below.