MUSCATINE, IA - The world's second largest office furniture maker, HNI Corp. (NYSE: HNI), says overall sales rose 3% third quarter, reaching $565.7 million. Net income rose 15%, to $28.1 million - aided its smaller home hearth business, which is rising with the housing market.

HNI is also spending millions retooling, and building a panel manufacturing plant in Muscatine.

Office furniture sales fell slightly, $12.5 million, or 0.3%. to $466.2 million for the quarter, partially a result of divestitures, according to Stan Askren, HNI CEO. HNI sells under multiple brands, including Hon, Allsteel, Gunlocke and Paoli.

"We continued to invest in new products and operational capabilities to meet changing market demands," said Stan Askren, HNI CEO. "We delivered solid sales and profit growth in our office furniture businesses despite a recent sharp decline in federal government spending." Federal purchases fell 30%, Askren said during an earnings report call-in, while other furniture segments grew 5%.

Last year HNI acquired BP Ergo, a Mumbai, India furniture manufacture, which contributed to the periods' overall office furniture sales.

Results also got a boost compared to year ago quarterly results, which included $800,000 in restructuring charges associated with a shutdown and consolidation of office furniture manufacturing locations. A residual charge of $100,000 in restructuring was taken against earnings this quarter.

Results also got a boost compared to year ago quarterly results, which included $800,000 in restructuring charges associated with a shutdown and consolidation of office furniture manufacturing locations. A residual charge of $100,000 in restructuring was taken against earnings this quarter.

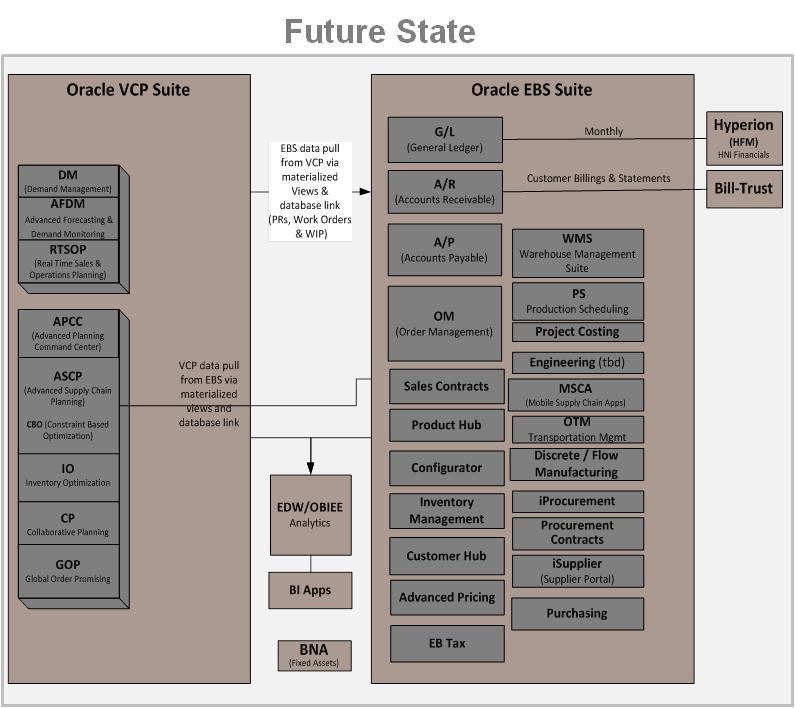

Capital expenditures during the first nine months were $59.6 million in 2013 compared to $44.7 million in 2012, including capitalized software. Expenditures "were primarily for tooling and equipment for new products, manufacturing investments for laminate capabilities and the on-going implementation of new integrated software systems to support business process transformation," says HNI. In Sept. 2012 HNI receive tax incentives to support a $20 million plant expansion in Muscatine.

Last quarter HNI predicted 2013 capital expenditures would be approximately $80 to $85 million, for new product development and related tooling, accelerated manufacturing investments for laminate capabilities and its business systems transformation project.

"We are investing in innovative new products relevant to the way people work," Askren said earlier this year. "Our expansion into the fast-growing architectural wall segment with a highly differentiated product has already received positive market response."

Have something to say? Share your thoughts with us in the comments below.